A tax deduction of RM8000 is claimable for parents with unmarried children aged 18 and above if they are a full-time student pursuing. You just need to enter your income deduction relief and rebate only.

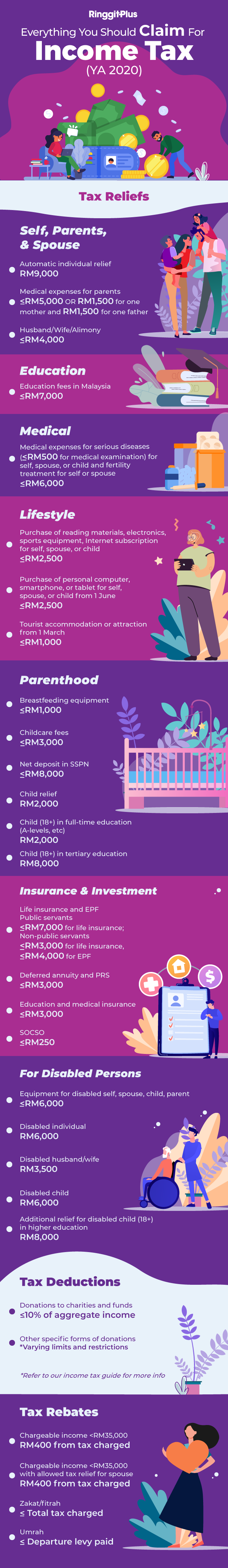

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

Malaysia Personal Income Tax 2021 Major Changes Youtube

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

Tax submission is also important to remain compliant with the law as corporate tax submission is required and governed by the Income Tax Act 1967.

.jpg)

Tax deduction malaysia. As part of the First Economic Stimulus Package announced on 27 February 2020 it was proposed that a tax deduction of up to RM300000 be given on costs for renovating and refurbishing business premises where such costs are incurred between 1 March 2020 and 31 December 2020 see EY Take 5. Finally list down the employees details for the current month. Tax Research Platform.

The standard deduction amounts will increase to 12400 for individuals and married couples filing separately 18650 for heads of household and. Below is the list of tax relief items for resident individual for the assessment year 2020. Everything You Should Claim As Income Tax Relief Malaysia 2020 YA 2019 Malaysia Personal Income Tax Guide 2020 YA 2019 Understanding Income Tax Reliefs Rebates Deductions And Exemptions In Malaysia.

The most important thing is you will get a faster refund in case you paid excess income tax through PCB. B a special deduction under section 34A of the ITA double deduction which has to be approved by the Minister. Malaysian personal tax relief 2021.

Tax Incentives in Malaysia. There are different types of tax incentives offered in Malaysia in the form of tax exemptions allowances related to capital expenditure and enhanced tax deductions. International Tax Review Asia Tax Awards 2021.

Currently expenses incurred on secretarial and tax filing fees are given a tax deduction of up to RM5000 and RM10000 respectively for each year of assessment YA under the Income Tax Deduction for Expenses in relation to Secretarial Fee and Tax Filing Fee Rules 2014 PU. Only formal alimony agreements are allowed for this tax relief. Medical self Claim allowed.

Gift of money to the government. ITA of 100 for five years for existing companies in Malaysia to relocate their overseas manufacturing facility for a new business segment to Malaysia with a minimum investment of MYR 300 million. Tax tables in Malaysia are simply a list of the relevent tax rates fixed amounts and or threholds used in the computation of tax in Malaysia the Malaysia tax tables also include specific notes and guidance on the validity of scenarios for example qualifying criterea for specific tax relief allowances and notes of the calculation of phaseout of specific tax elements within each.

Subscriptions to professional bodies. The membership subscription paid to professional bodies for ones profession like medical or legal professional fees can be claimed as a deduction. The following table is the summary of the offences fines penalties for each offence.

The gross amount of interest royalty and special income paid by the payer to a NR payee are subject to the respective withholding tax rates of 15 10 and 10 or any other rate as prescribed under the Double Taxation Agreement between Malaysia and the. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax. 30 2022 or as far as Dec.

This also includes any income from outside of Malaysia they have to be dependent on you for this claim to be made. Please refer to PR No. 0 tax rate for 10 or 15 years for new companies that invest a minimum of MYR 300 million or MYR 500 million respectively in the manufacturing sector in Malaysia.

Tax relief deduction. Tax deduction on costs for renovation and refurbishment of business premises. Tax deduction for secretarial and tax filing fees.

Money Politics. 31 2022 with the deduction being delayed until the taxable year in which payment is made. A Malaysian company can claim a deduction for royalties management service fees and interest charges paid to foreign affiliates provided that these are made at arms length and the relevant WHTs where applicable have been deducted and remitted to the Malaysian tax authorities.

PCB is deducted from the employees taxable income only. For example if you take up a job while overseas and you only receive the payment for the job when you are back in Malaysia. Or c a special deduction under section 34B of the ITA double deduction which have to be approved by the Minister.

Also LHDN extended the dateline for extra 2 weeks. As per Income Tax Act ITA 1967 any person who committed for an offence will be fine either through penalty of imprisonment or both depending on severity or the number of offences. Any company that is registered with the Companies Commission Malaysia aka.

In the recently announced International Tax Review ITR Asia Tax Awards 2021 Deloitte Malaysia has won two ITR awards. A diploma or higher excluding the above mentioned preparatory courses in Malaysia. Malaysia Income Tax Rebate YA 2019 Explained.

The relief amount you file will be deducted from your income thus reducing your taxable incomeMake sure you keep all the receipts for the payments. Malaysia offers a wide range of tax incentives for the promotion of investments in selected industry sectors which include the traditional manufacturing and agricultural sectors as well as other sectors such as those involved in Islamic financial services ICT education tourism healthcare as well as research and development. Up to value of gift unless otherwise stated.

30 2021 thereby receiving a tax deduction for the amount paid in that taxable year and defer the remaining amount until Jun. Sole proprietors and owners of pass-through businesses are eligible for a deduction of up to 20 to bring the tax rate lower for qualified. Alternatively the employer could balance the deferral and tax deduction timing by paying 50 of the deferral by Jun.

Double Tax Deduction for Internationalisation DTDi Overview Companies planning to expand overseas can benefit from the Double Tax Deduction Scheme for Internationalisation DTDi with a 200 tax deduction on eligible expenses for international market expansion and. Identify the Terms Conditions for PCB Calculation Where to deduct the PCB amount from. Suruhanjaya Syarikat Malaysia SSM is required to pay corporate tax to avoid penalties for non-compliance with the tax law.

For the fourth time in the last 5 years we have been named the coveted Malaysia Tax Firm of the Year. Although the income is exempted from tax tax will have to be paid on the dividends paid on tax exempted income. In the case of alimony paid to a former wife the deduction is allowed for the amount of alimony paid or up to a limit of RM4000.

Lhdn Irb Personal Income Tax Relief 2020

.jpg)

Guidelines On Tax Deduction For Sponsorship Of Arts Cultural And Heritage Activities And Programmes Articles Cendana

Ttcs Tax Reliefs Ya 2020 Thannees

Malaysia Payroll And Tax Activpayroll

List Of Lhdn S Income Tax Relief For E Filing 2021 Ya 2020

Focus Malaysia Taxation In Malaysia Expense Deduction Dilemma Thannees

Prs Tax Relief Private Pension Administrator

Special Tax Deduction On Rental Reduction