Cost of Goods Manufactured 5000 million 3935 million 4600 million. Cost of goods sold is an important figure for investors to consider because it has a direct impact on profits.

Financial Statement Issues That Are Unique To Manufacturers Principlesofaccounting Com

Solved Prepare A Condensed Cost Of Goods Manufactured Schedule For Case 1 Answer Transtutors

Cost Of Goods Manufactured Important 2021

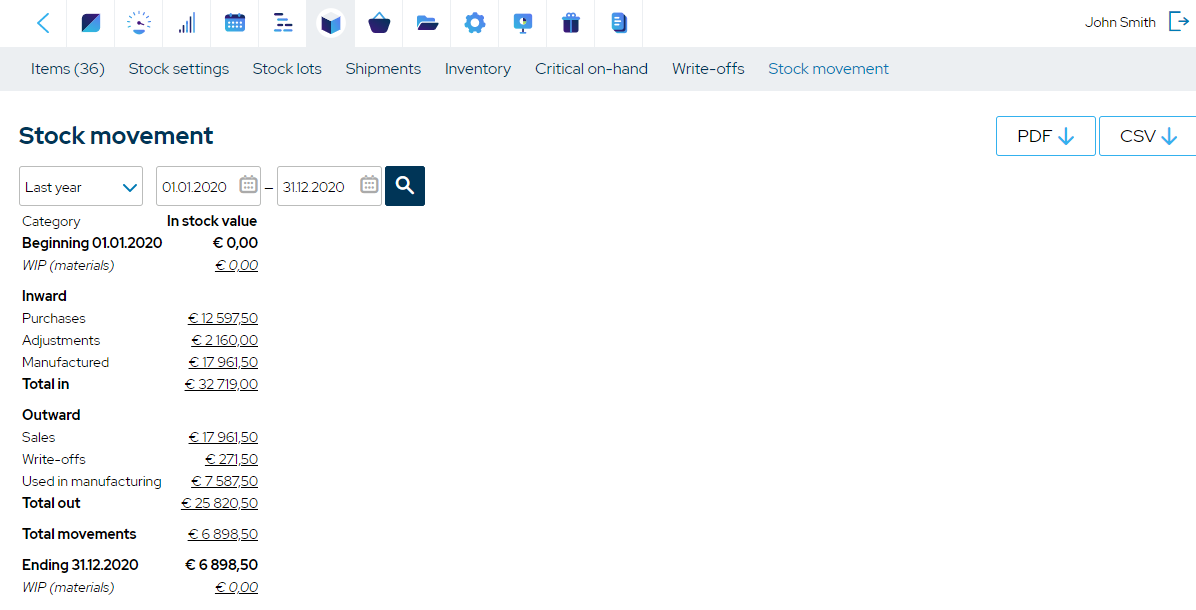

The equation calculates the manufacturing costs incurred with the goods finished during a specific period.

Cost of goods manufactured. It not only includes the cost of materials and labor but also both for the company during a specific period of time. The cost of goods manufactured schedule is used to calculate the cost of producing products for a period of time. A final good or consumer good is a commodity that is used by the consumer to satisfy current wants or needs unlike intermediate goods which is utilized to produce other goods.

It is primarily used in financial accounting as part of the process of compiling the financial statements. Cost of Goods Manufactured 4335 million. Some systems permit determining the costs of goods at the time acquired or made but assigning costs to goods sold under the assumption that the goods made or acquired last are sold first.

Materials to create the good. Be careful not to confuse the terms total manufacturing cost and cost of goods manufactured with each other or with the cost of goods sold. Therefore 2500 is the cost of goods sold.

The cost of goods sold COGS is a significant part of a business Income Statement and plays an essential role in calculating the net income for a business. Hence it will always be lesser than the cost of sales. COGS refers to the cost of goods that are either manufactured or purchased and then sold.

We also offer free US-based support. Cost of Goods Manufactured COGM is a term used in managerial accounting that refers to a schedule or statement that shows the total production costs Absorption Costing Absorption costing is a costing system that is used in valuing inventory. The oldest cost ie the first in is then matched against revenue and assigned to cost of goods sold.

It not only includes the cost of materials and labor but also both for a company during a specific period of. It consists of only those costs which are incurred during the production process. Understanding the cost of goods sold COGS helps businesses to find out about their financial health and profitability.

Cost of goods sold COGS is the cost of acquiring or manufacturing the products that a company sells during a period so the only costs included in. COGS count as a business expense and affect how much profit a company makes on its products according to The Balance. Below is the COGS Formula extended to include returns discounts allowances and freight charges.

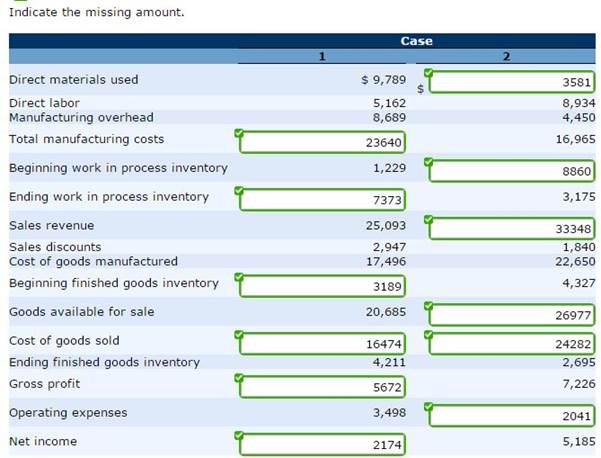

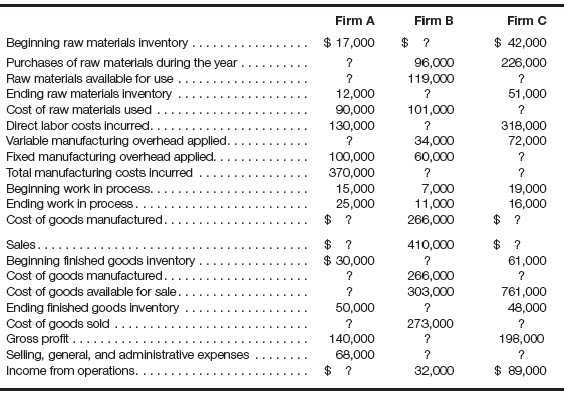

Therefore the cost of goods manufactured incurred by ZXC Inc. The two most important numbers on this statement are the total manufacturing cost and the cost of goods manufactured. Cost of goods sold only includes the expenses that go into the production of each product or service you sell eg wood.

COGS include the following costs. The cost of Goods sold majorly includes the direct cost of the company. Cost of Goods Sold COGS Cost of goods sold is the accounting term used to describe the expenses incurred to produce the goods or services sold by a.

During tax time a high COGS would show increased expenses for a business resulting in lower income taxes. Gross profit in turn is a measure of how efficient a company is at managing its operations. Cost of goods sold COGS is the cost of acquiring or manufacturing the products that a company sells during a period so the only costs included in the measure are those that are directly tied to the production of the products including the cost of labour materials and manufacturing overhead.

It is the end product of the company which is ready. When used in measures of national income and output the term final goods includes only new goods. The formula for the cost of goods manufactured can be derived by using the following steps.

Cost of goods manufactured COGM is the sum total of manufacturing costs incurred on finished goods that have been produced within a specific accounting period. A manufacturer is more likely to use the term cost of goods sold. Last-In First-Out LIFO is the reverse of FIFO.

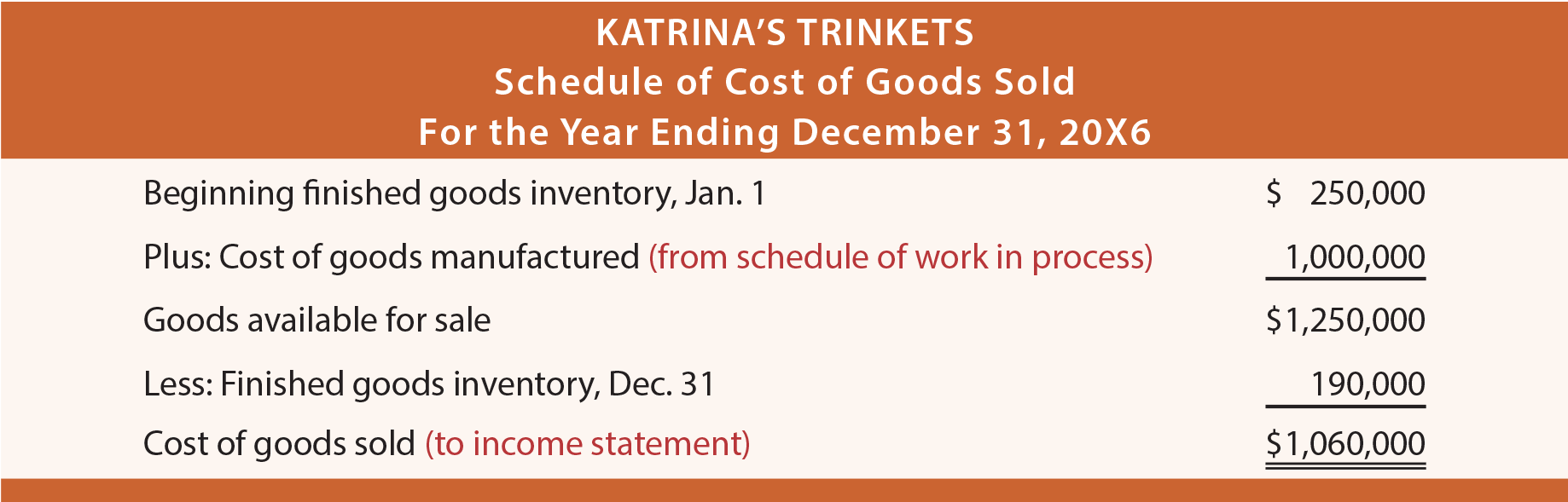

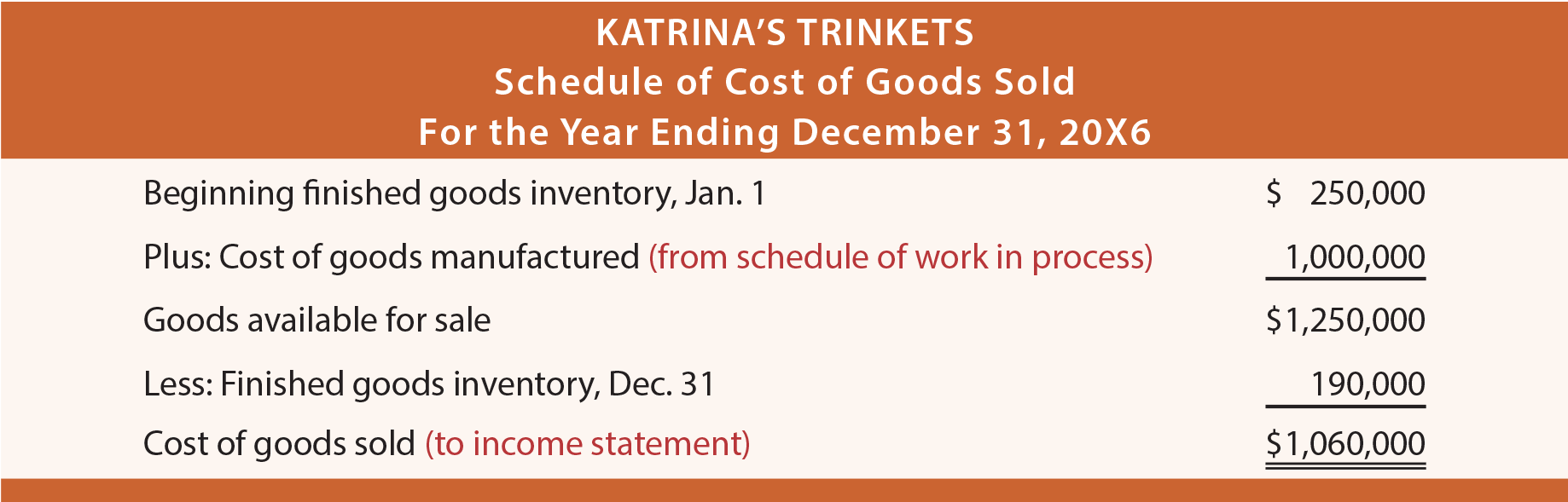

It is the amount of money spent by a company on its labor materials and overheads to manufacturepurchase products of the goods that are sold to customers during the year. Cost of goods sold is deducted from revenue to determine a companys gross profit. The cost of goods manufactured amount is transferred to the finished goods inventory account during the period and is used in calculating cost of goods sold on the income statement.

The cost of goods manufactured COGM is a calculation that is used to gain a general understanding of whether production costs are too high or low when compared to revenue. Are you computing your cost of goods sold and need a way to record your journal entries. Journal example of how to record the cost of goods sold.

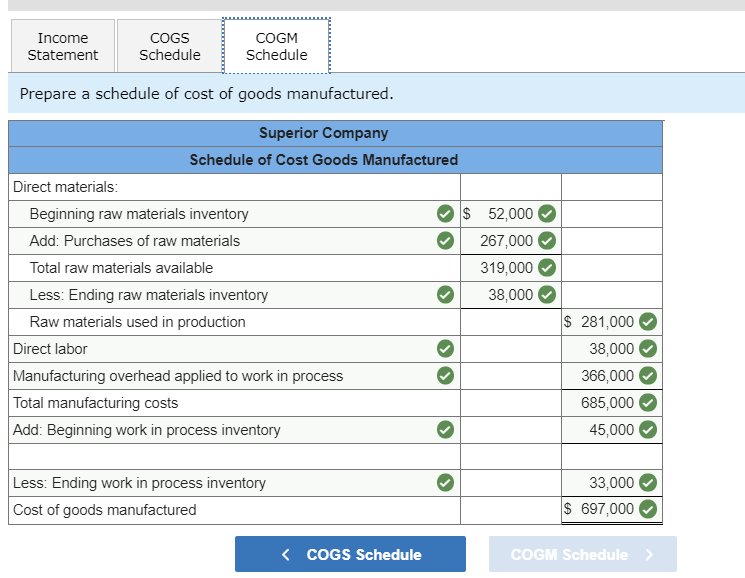

The cost of goods manufactured schedule is used to calculate the cost of all items produced during a reporting periodThe total derived from this schedule is then used to calculate the cost of goods sold for the reporting period. You should record the cost of goods sold as a debit in your accounting journal. Cost of goods sold is found on a businesss income statement one of.

Cost of Goods Sold COGS The cost of goods sold is the cost of the products that a retailer distributor or manufacturer has sold. What is Cost of Goods Manufactured COGM. Cost of Goods Manufactured COGM is a term used in managerial accounting that refers to a schedule or statement that shows the total production costs Absorption Costing Absorption costing is a costing system that is used in valuing inventory.

For higher net profits businesses want to keep their COGS as low as possible. The term is most commonly used by retailers. As per the cost of goods sold formula COGS is 2000 1500 -1000 2500.

COGS is also known as the cost of doing business. A microwave oven or a bicycle is a final good whereas the parts purchased to manufacture it are intermediate goods. If the cost of goods sold is high net income may be low.

Extended COGS Formula. What is a Cost of Goods Manufactured Schedule. During the year 2018 was 4335 million.

Patriots online accounting software makes it easy to record business expenses. What is the Cost of Goods Available for Sale. The cost of goods sold is calculated on the number of goods manufactured by the company.

The cost of goods sold COGS also contributes to the taxable income. The cost of goods available for sale refers to the cost of total goods produced during the year after accounting for the cost of finished goods inventory Finished Goods Inventory Finished goods inventory refers to the final products acquired from the manufacturing process or through merchandise. The statement of cost of goods manufactured supports the cost of goods sold figure on the income statement.

The cost of sales is a key part of the performance metrics of a company since it measures the ability of an entity to design source and manufacture goods at a reasonable cost. Enter the cost of materials labor manufacturing overhead beginning work in process inventory and ending work in process inventory into the calculator to. Your cost of goods sold also known as cost of sales or cost of services is how much it costs to produce your businesss products or services.

The cost of sales will always be greater than the cost of goods sold as it includes other additional costs as well.

Solved Cost Of Goods Manufactured Cost Of Goods Sold And Income Chegg Com

Cost Of Goods Manufactured Formula Examples With Excel Template

Solved Prepare Schedules Of Cost Of Goods Manufactured And Chegg Com

Cost Of Goods Manufactured Cogm How To Calculate Cogm

1

.png)

Solved An Incomplete Cost Of Goods Manufactured Schedule Is Presented Below Solutioninn

Part 3 Schedule Of Cost Of Goods Manufactured Youtube

How To Calculate The Cost Of Goods Manufactured Cogm Mrpeasy