When trying to decide whether to invest in a certain stock using the PE can help you explore the stocks future direction. As an example if share A is trading at 24 and the earnings per share for the most recent 12-month period is 3 then share A has a PE ratio.

Pe Ratio Price To Earnings Definition Formula And More Stock Analysis

How To Calculate The Intrinsic P E Of A Stock Quora

P E Ratio What Is A Company S Price To Earnings P E Ratio

You should not use such information for purposes of any actual transaction without consulting.

How to use pe ratio. Looking at the PE of a stock tells you very little about it if its not compared to the companys historical PE or the competitors PE from the same industry. Price Earnings Ratio 1594. In short the PE shows what the market is.

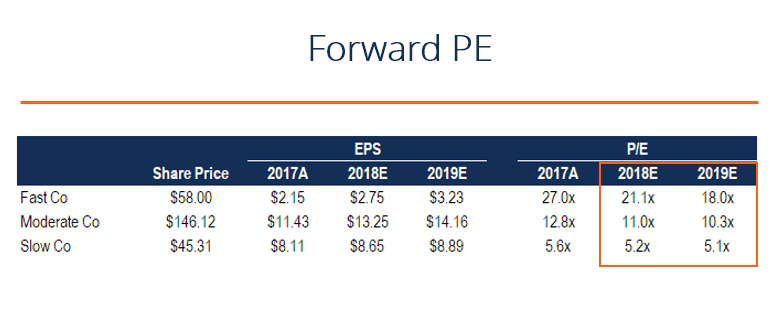

View United Kingdoms PE ratio from 14 Jun 1993 to 18 Nov 2021 in the chart. Examples Now lets take two examples of forward price to earnings ratio Price To Earnings Ratio The price to earnings PE ratio measures the relative value of the corporate stocks ie whether it is undervalued or overvalued. There isnt necesarily an optimum PE ratio since different industries will have different ranges of PE Ratios.

When this happens you should use other indicators such as PBV or PS. Nifty PE Ratio PB Ratio Dividend Yield Ratio Charts. Price to Earnings Ratio or PE is price earnings.

The PE ratio reached an all-time high of 34210 in Sep 2016 and a record low of 7410 in Mar 2009. All Ordinaries fundamental data back to 1980. Use Nifty PE to compare current valuation of Nifty 50 with historic Nifty PE PB Div Yield values.

PE ratio is a measure of the valuation of a companys stock. It has price in the numerator and earnings in the denominator. On the other hand the Shiller PE ratio was at 133 its lowest level in decades correctly indicating a better time to buy stocks.

Since the Nifty 50 is a bellwether index the Nifty PE is used as a gauge to know if markets are expensive or cheap. The most common use of the PE ratio is to gauge the valuation of a stock or index. The PE ratio is a simple way to assess whether a stock is over or under valued and is the most widely used valuation measure.

Trying hands at bargain stocks that have a low price-to-earnings PE ratio is a common practice. Current and historical pe ratio for Target TGT from 2006 to 2021. FTSE Russell provides daily PE Ratio.

How to Use the PE Ratio. Price Book Ratio 144. Current and historical pe ratio for Tesla TSLA from 2009 to 2021.

Has a trailing-twelve-months PE of 21754X compared to the Automotive - Domestic industrys PE of 1736X. Then they can use the same formula to find out about the Forward PE Ratio. About PE Ratio TTM Tesla Inc.

Historical statistics PE Earnings Dividend Yield for the Australian stock market. A price-to-earnings ratio or PE ratio is the measure of a companys stock price in relation to its earnings. The higher the PE ratio the more expensive the stockPB ratio.

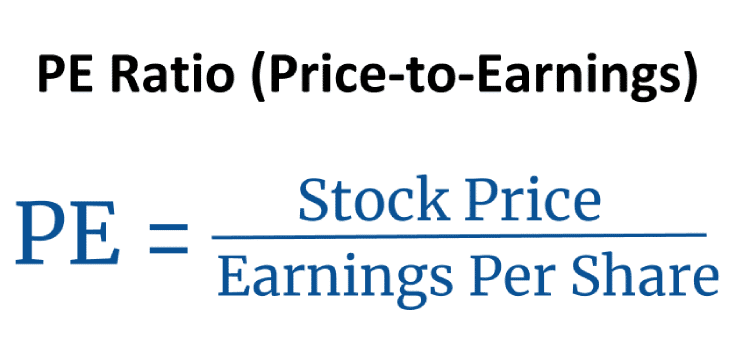

The most commonly-used one is called the Price-to-Earnings PE ratio which divides the price of a share of stock by the annual earnings per share of that stock. The forward PE ratio or forward price-to-earnings ratio divides the current share price of a company by the estimated future forward earnings per share EPS Earnings Per Share Formula EPS EPS is a financial ratio which divides net earnings available to common shareholders by the average outstanding shares over a certain period. The same when applied to the Nifty 50 stocks becomes the index PE ratio.

Normally you want to buy a healthy and growing company when its shares are trading at a low PE. Another reason why the PE ratio cannot be solely used to make an investment decision is that the earnings of a company are released every quarter whereas stock prices fluctuate every day. The PE ratio was high because earnings were depressed.

The table below lists the current historical PE TTM ratio CAPE ratio of the NASDAQ-100 indexThe current 6302021 trailing price-to-earnings ratio of the index is 3769NASDAQ-100 tracks the performance of the 100 largest non-financial companies listed on the Nasdaq stock market. The price-earnings ratio also known as PE ratio PE or PER is the ratio of a companys share stock price to the companys earnings per share. With the PE ratio at 123 in the first quarter of 2009 much higher than the historical mean of 15 it was the best time in recent history to buy stocks.

PE Ratio in Use. We note that for 2016 Stock DDD has the highest Forward PE Ratio 287x in 2016E and 383x in 2017E This implies that Stock DDD is the most expensive stock from the above table. PE ratio is considered a key valuation metric to know how expensive a stock is in relation to its peers.

A negative PE ratio has no useful interpretation. Price to Earnings PE Ratio Analysis. The Price to Earnings Ratio PE Ratio is calculated by taking the stock price EPS ttm.

Its not easy to conclude whether a stock with a PE of 10x is a bargain or a PE of 50x is expensive without performing any comparisons. The ratio is used for valuing companies and to find out whether they are overvalued or undervalued. The PE ratio is a simple way to assess whether a stock is over or under valued and is the most widely used valuation measure.

Calculation of PE ratio does not consider the EPS growth rate of a company which is why investors also use PEG ratio or Price to Earnings to Growth ratio to decide which company holds more promise. This metric is considered a valuation metric that confirms whether the earnings of a company justifies the stock price. The price-earnings ratio PE ratio is the ratio for valuing a company that measures its current share price relative to its per-share earnings.

The price to earnings ratio is calculated by taking the latest closing price and dividing it by the most recent earnings per share EPS number. The Forward Price-to-Earnings or Forward PE Ratio. In the latest reports FTSE 100 closed at 6969815 points in Apr 2021.

Price-Earnings Ratio - PE Ratio. The perception is that the lower the PE the higher will be the value of the stock. The price to earnings ratio is calculated by taking the latest closing price and dividing it by the most recent earnings per share EPS number.

Sometimes the PE ratio can be of no use at all. Forward PE ratio formula Price per shareProjected earnings per share read more Ratio of these 3 stocks. If a company has made losses and earnings are negative so is the PE ratio.

The higher the ratio the more expensive a stock is relative to its earnings. The PE ratio helps investors determine the market value of a stock as compared to the companys earnings.

What Is P E Ratio Youtube

5 Steps To Using P E Ratio Effectively Kclau Com

Forward P E Ratio Example Formula And Downloadable Template

Price To Earnings P E Ratio And Earnings Per Share Eps Explained Youtube

Price To Earnings Ratio Pe Ratio Definition

P E Ratio For Cryptocurrencies We Can Compute P E Ratios For By Eloise Coinmonks Medium

Price To Earnings P E Ratio Definition

Cyclically Adjusted Price To Earnings Ratio Wikipedia