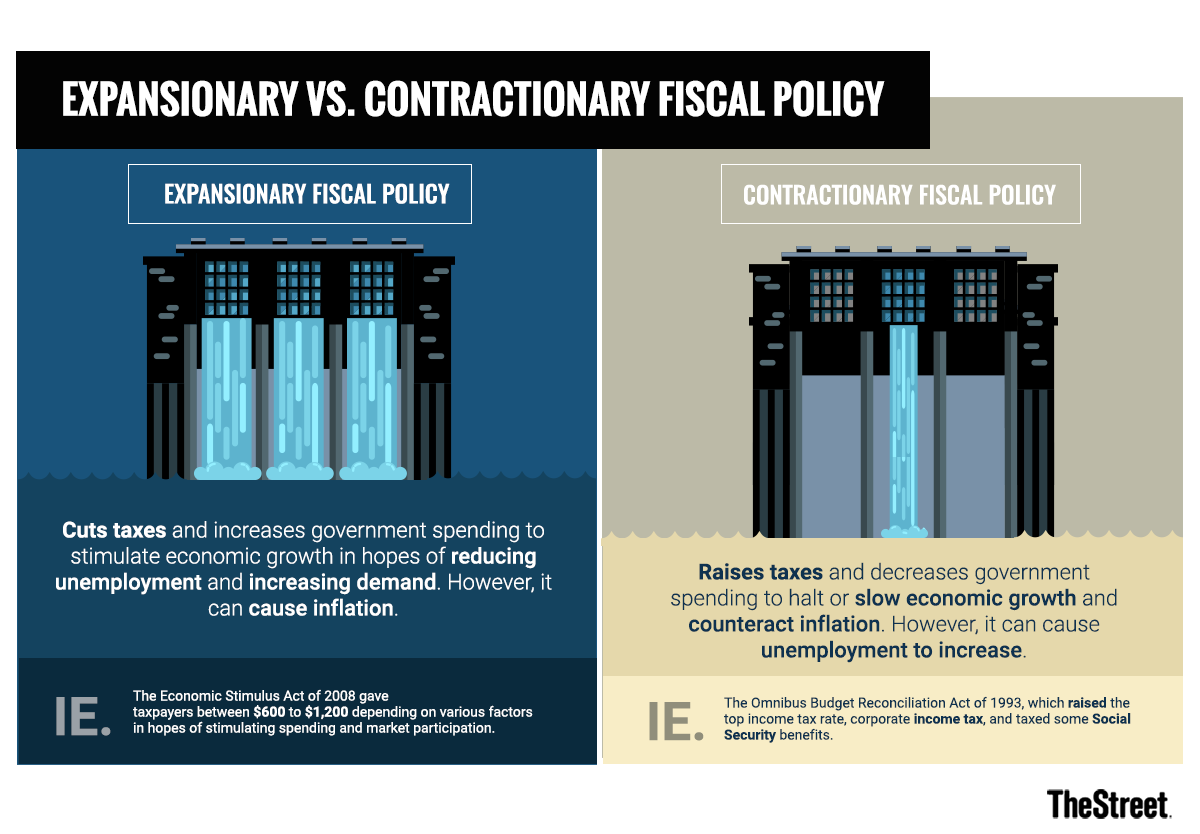

A tight or restrictive fiscal policy includes raising taxes and cutting back on federal spending. At the same time the Fed should enact contractionary monetary.

3 Types Of Fiscal Policy Boycewire

Chapter 14 Fiscal Policy Deficits And Debt Fiscal

/GettyImages-921163230-b5f0f9a4cd384fb2839855a57edea139.jpg)

What Is Fiscal Policy How It S Used The Effects

Fiscal policy involves the government changing the levels of taxation and government spending in order to influence aggregate demand AD and the level of economic activity.

/what-is-fiscal-policy-types-objectives-and-tools-3305844-final-5b4e4a59c9e77c005bbfde3a.png)

Fiscal policy includes. Expansionary Discretionary Fiscal Policy. Taxes come in many varieties and serve different specific purposes but the key concept is that taxation is a transfer of assets from the. It is the sister strategy to monetary policy through which a.

AD is the total level of planned expenditure in an economy AD C I G X M The purpose of Fiscal Policy. If the purpose of expansionary fiscal policy was to stimulate GDP and employment ie. The flipside of the expansionary fiscal policy is a contractionary fiscal policy which includes increasing taxes or diminishing government spending shifting aggregate demand to the left.

Discretionary Fiscal Policy versus Monetary Policy. These include tax policy expenditure policy investment or disinvestment strategies and debt or surplus management. Fiscal policy is the management of government spending and tax policies to influence the economy.

Figure 1 in essay rhetorical questions to start an essay mangani festival essay. Most of these plans were based on the Keynesian theory that deficit spending by governments can replace some of the demand lost during a recession and prevent the waste of. While the main objective of fiscal policy is to influence the aggregate output of the economy the main objective of the monetary policies is to control the interest and inflation rates.

Both the executive and legislative branches of the government determine fiscal policy and use it to influence the economy by adjusting. Essay on education problems in pakistan. Current government spending includes goods and services which it regularly provides.

In my view the big debate between fiscal policy and monetary policy or inflation vs deflation mostly comes down to looking at a long enough historical timeline to see the full context. Fiscal policy is an important constituent of the overall economic framework of a country and is therefore intimately linked with its general economic policy strategy. The pandemic will leave a lasting mark on inequality poverty and government finances our latest Fiscal Monitor finds.

With this decreased demand then the economys growth is slowed. The latter on the contrary encroaches directly upon the market mechanism and gives rise to an allocation of resources which may be construed as good or bad depending upon ones value judgements. For an analysis that includes multipliers as well as a more detailed breakdown of the components of the FIM read our explainer on how pandemic-era fiscal policy affects the level of.

Fiscal policy is a corrective measure of a government to check uncontrolled economic expansion or contraction. Explore the tools within the fiscal policy toolkit such as expansionary and contractionary fiscal. This figure includes both public and nonfinancial private sector debt.

An argumentative essay outline essay writing on earth day breakfast descriptive essay essay with tamil meaning. When monetary policy is general in nature and impersonal in impact the fiscal policy in contrast is selective. Fiscal Policy is the use of Government spending and taxation levels to influence the level of economic activity.

Fiscal policy is a crucial part of American economics. Fiscal policy and monetary policy are the two primary tools used by the State to achieve its macroeconomic objectives. At its best discretionary fiscal policy should work in alignment with monetary policy enacted by the Federal Reserve.

Fiscal policy including both automatic stabilizers and pandemic-related tax and spending legislation played a significant role in cushioning the blows to. By levying taxes the government receives revenue from the populace. Macroeconomic Policies The following is from the lecture on Macroeconomic Policies NOTE.

The objective of fiscal policy is to maintain the condition of full employment economic stability and to stabilize the rate of growth. A Keynesian stimulus for the short-term the extent to which crowding out occurs will limit the stimulus. With fewer jobs and higher taxes both families and businesses are left with less income available for spending.

The Fiscal and Monetary Policy Framework that was implemented provided a solid. Fiscal policy is the means by which a government adjusts its spending levels and tax rates to monitor and influence a nations economy. With the pandemic global debt in 2020 jumped by 14 percent to a record high 226 trillion.

Here we will look at fiscal policy designed to achieve low unemployment or low inflation. Kargil victory day essay. Contractionary fiscal policy slows growth which includes job growth.

Such services include defense health and education. Fiscal policy is composed of several parts. Beginning in 2008 many nations of the world enacted fiscal stimulus plans in response to the Great RecessionThese nations used different combinations of government spending and tax cuts to boost their sagging economies.

If the economy is growing too fast fiscal policy can apply the brakes by raising taxes or cutting spending. This expenditure aims at at improving a countrys labor productivity. Describe tools of fiscal policy.

Monetarist and Keynesian view. When I use the term policies I always mean government policies. Criticisms include - crowding out inflationary impact inefficiency of govt intervention.

If economic expansion gets out of hand it will lead to hyperinflation while unchecked contraction can push an economy towards deflation Deflation Deflation is defined as an economic condition whereby the prices of goods and services go down constantly with. The effectiveness of monetary policy including interest rate manipulation and asset purchases diminishes significantly when debt is high interest rates hit the zero bound and the money multiplier is low. Fiscal policy refers to the tax and spending policies of a nations government.

The first is taxation. Explore how the pandemiccoronavirus impacted global economy Purpose of Expansionary Fiscal Policy. Definition of fiscal policy.

If say a 100 billion increase in government spending results in a 50 billion decrease in private investment spending then the net increase to total expenditure is 50 billion instead of 100 billion. Fiscal policy describes two governmental actions by the government. The former permits the market mechanism to operate smoothly.

Essay about levels of management small essay on balloon 12 policy Fiscal grade essay. This includes energy and financial sector costs and a gradual medium-term fiscal adjustment expected to. Fiscal policy must be designed to be performed in two ways-by expanding investment in public and private enterprises and by diverting resources from socially less desirable to more desirable investment channels.

/what-is-fiscal-policy-types-objectives-and-tools-3305844-final-5b4e4a59c9e77c005bbfde3a.png)

Fiscal Policy What Is It

Fiscal Policy

What Is Fiscal Policy Examples Types And Objectives Thestreet

Expansionary And Contractionary Fiscal Policy Macroeconomics

1

How Biden S Fiscal Policy Affects The Deficit The Debt And You Divided We Fall

1

How Pandemic Era Fiscal Policy Affects The Level Of Gdp